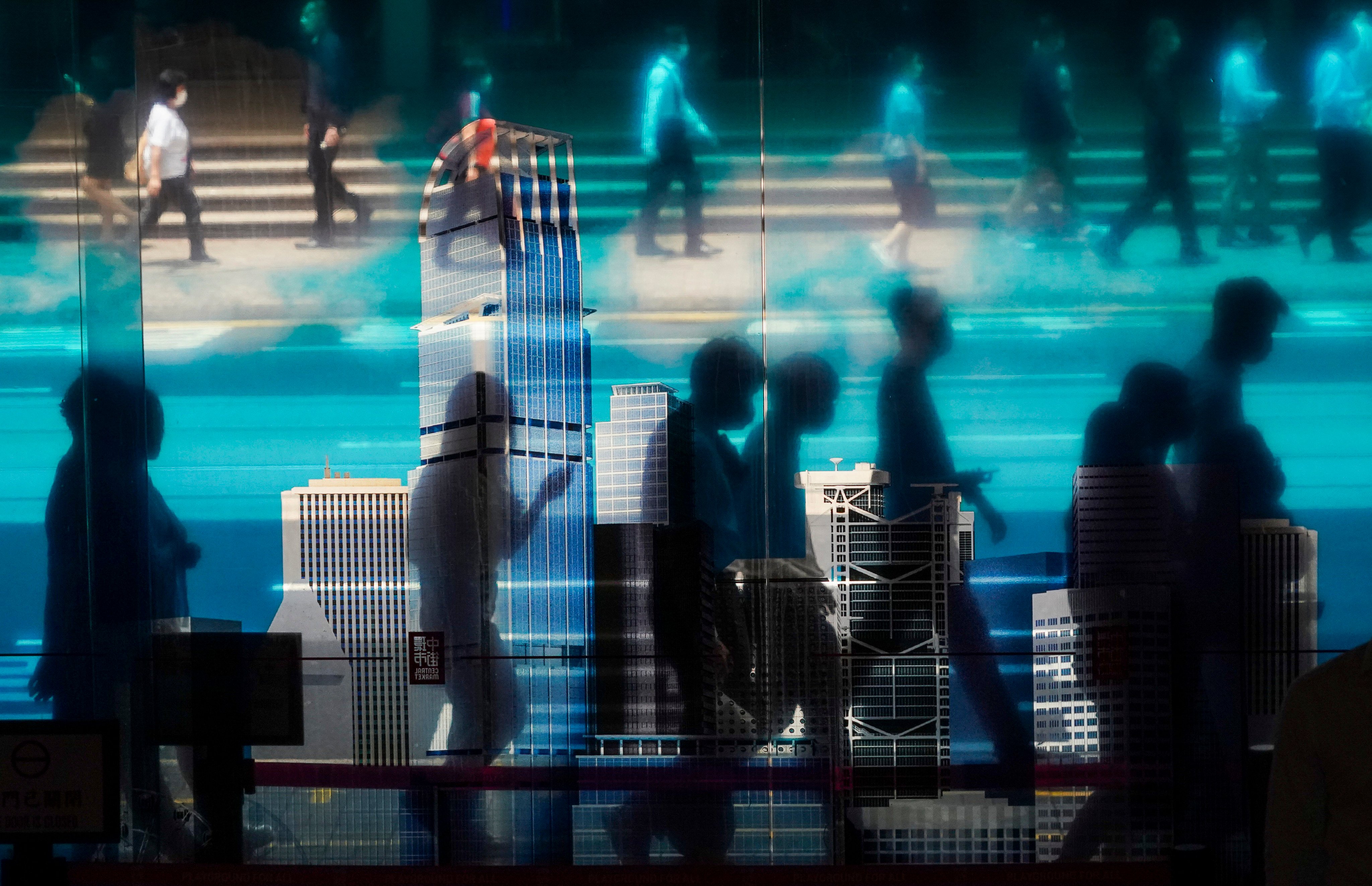

Hong Kong’s mandatory retirement fund put in its best performance in seven years in the first five months of 2024, though members who shifted their cash from Hong Kong and China equities to US stock funds have missed out.

HSBC arranged a three-day tailored programme in California last week for its Asian private bank clients to meet Silicon Valley start-ups and venture capitalists.

The Asian Family Legacy Foundation, which held its inauguration ceremony in Hong Kong on Wednesday, considers the city an ideal location for family offices to get together to carry out their missions in charity work and cultural exchanges.

Hong Kong can be a fundraising hub for AI start-ups as it has deep capital pools and plays a connector role in Asia, says partner at European venture capital firm Alpha Intelligence Capital.

The financial services secretary, Christopher Hui Ching-yu, has denied media reports that a major stock market reform that would see trading continue as normal during typhoons and torrential rains has been postponed.

Hong Kong’s tax breaks and immigration policies to attract tycoons to set up family offices have been quite successful, as they have piqued the interest of many billionaires over the past year, banker says.

BYD Electronic, which makes electronic devices such as smartphones for brands including Huawei, will add HK$76.15 billion (US$9.8 billion) in market capitalisation to the benchmark.

The private bank has increased its headcount, mainly relationship managers and senior bankers, by 15 per cent this year. It sees Hong Kong, Singapore and Dubai as stepping stones to expand its business.

Hong Kong’s market regulator has warned the public to beware of a suspected investment scam in which fraudsters claim they are trying to raise the funds to relaunch one of the city’s iconic nightclubs.

Starwood Capital Group, one of the largest real estate investors worldwide, is part of a consortium of shareholders proposing to take Asian warehouse developer ESR Group private.

The incentives will inject a dose of optimism and confidence in the capital markets, enhance cross-border trading schemes and boost the yuan, tax experts say.

Hong Kong Exchanges and Clearing, which runs the third-largest stock exchange in Asia, sees more listings from the Middle East and mainland China as market sentiment turns bullish, according to its CEO.

The new financial product underscores the flurry of collaborations and accords between Hong Kong and Riyadh since the February 2023 visit by Chief Executive John Lee Ka-chiu to the kingdom.

The removal of property curbs, a stock market rebound and growing opportunities in the Greater Bay Area are attracting an increasing number of family offices to Hong Kong, according to industry players.

Swiss financial firm EFG has increased its investment in Chinese and other non-Japan Asian stocks, on expectations of steady growth in the region and driven by the belief the worst was over for stocks in China.

Hong Kong will roll out the red carpet to hundreds of top global bankers and finance executives in November for a high-level financial conference to be hosted by the Hong Kong Monetary Authority.

Hong Kong’s Exchange Fund, the war chest used to defend the local currency, continued its comeback in the first quarter, posting a return of HK$54.3 billion (US$7 billion) as rising overseas stock markets offset losses in domestic equities.

The HKMA plans to replace the term ‘virtual bank’ with ‘licensed digital bank’ in reference to the city’s eight branchless lenders to remove negative connotations associated with the term in Chinese.

The HKMA has issued a ‘green taxonomy’ framework to help banks and investors determine the sustainability of economic activities, the latest effort to boost the city’s standing as a green finance centre.

Mainland China investors will gain access to Hong Kong’s Reits via an expanded mutual market access scheme in a move which will deepen the market, enhance its liquidity and attract international issuers, analysts say.

Hong Kong will implement sound cybersecurity measures reinforced by strong backup systems to ensure a smooth launch of the MPF electronic platform next month, according to the MPFA’s Ayesha Lau.

Hong Kong’s biggest lenders including HSBC, Standard Chartered and BOCHK will keep their key lending and deposit rates unchanged, meaning local businesses and mortgage borrowers will have a longer wait for the cost of borrowing to decline.

HKMA reiterated its warning for Hong Kong’s borrowers to “carefully assess” their financial power in considering buying property or taking on mortgages, as high interest rates “may last some time.”

Hong Kong’s largest virtual bank is preparing to introduce virtual asset trading services for retail investors, CEO Ronald Iu says. Plans are afoot as a new regulatory regime is rolled out in June.

Hong Kong kept its key interest rate unchanged for a sixth consecutive time in lockstep with the Federal Reserve’s overnight decision, with sticky US inflation forcing investors to delay rate cut bets.

Mainland China visitors to Hong Kong during the golden week holiday period will be offered a host of freebies by banks vying for their business amid growing interest in the city’s cash-for-residency scheme.

It’s thumbs-up for China’s latest move to broaden the ETF Connect scheme. The impending changes will encourage more products and capital inflows into the city’s financial market, according to panellists at a conference.

Carlson Tong Ka-shing, a veteran accountant and former head of the city’s market regulator, will work with CEO Bonnie Chan, as the exchange grapples with low market turnover and a decline in new listings.

Net profit for the January-to-March period came in at HK$2.97 billion (US$380 million), or HK$2.35 per share, beating a consensus estimate of a 14 per cent decline and improving on the fourth quarter of 2023 by 14 per cent.

ESG reporting and the Greater Bay Area offer opportunities for young accountants, and the IPO market is set to recover, new HKICPA president Roy Leung says.