Topic

Stock market action from around the world, with a focus on Hong Kong, China and the rest of Asia.

Rebound of Hang Seng Index may have confounded the doom mongers, but Hong Kong also needs to attract liquidity and reclaim a top position for IPOs.

Trade data provides cautious economic optimism, but Beijing must take measures to boost domestic spending to ensure recovery is not overreliant on exports.

Attracting listings to the bourse from Southeast Asia, the Middle East and other regions, and introducing trading when typhoon signal No 8 is in force are at the top of his list.

- Combined net assets increased 5.4 per cent month on month in April to more than 30 trillion yuan (US$4.1 trillion), industry association says

- Shift reflects demand for risk assets as investors look to put an abundant pool of cash to work at a time when the property market is a poor option

Hong Kong stocks fell for a fourth straight day and capped their biggest weekly loss since January, with a lack of positive earnings surprises and waning rate cut hopes adding to the gloom.

Hong Kong’s mandatory retirement fund put in its best performance in seven years in the first five months of 2024, though members who shifted their cash from Hong Kong and China equities to US stock funds have missed out.

A stock market rally in Hong Kong has helped raise valuations and improve sentiment among investors, feeding a recovery in fundraising activities in the city and on bourses in mainland China, JPMorgan says.

China’s securities regulators and stock exchange officials met with global fund managers in Europe in the first overseas roadshow, after delivering a major stimulus to rescue the nation’s property market.

High dividend stocks may extend their outperformance, driven by haven-seeking investors in an uncertain economic environment, analysts say.

Hong Kong stocks fall to two-week low as correction deepened after hawkish comments from US Federal Reserve officials.

Growing scepticism and a lack of trust in the performance of ESG investments are the ‘top barrier’ for Asian investors, according to a study by AXA Investment Managers.

Haidilao operator Super Hi International plans to use 70 per cent of the listing proceeds to strengthen brand and expand network globally. The US debut adds momentum for Chinese firms weighing a listing abroad.

‘It’s too early to leave the party,’ says an HSBC analyst as Goldman raises its index targets by at least 5 per cent, but JPMorgan Private Bank calls an end to the rebound.

Hong Kong-traded shares of Chinese dual-listed companies are at their smallest discounts to their counterparts on the mainland in 15 months as global investors pile in after Beijing launches measures to rescue the crisis-hit property sector.

Consumer and entrepreneur confidence should ‘continue to pick up from this point’ as Beijing’s efforts strengthen the capital markets and enhance Hong Kong’s connector role, say speakers at the Greater China Private Equity Summit.

The financial services secretary, Christopher Hui Ching-yu, has denied media reports that a major stock market reform that would see trading continue as normal during typhoons and torrential rains has been postponed.

Hong Kong stocks at 10-month highs after China’s property support measures cheer investors.

Economist Richard Koo’s theories influenced Western policy decisions after the global financial crisis, and now he has strong words for Chinese policymakers on the need for fiscal stimulus to ward off a ‘balance-sheet recession’.

Paul Chan says varying success of economic recovery across business sectors needs action to promote more growth.

A wave of mergers and acquisitions is about to transform China’s brokerage industry as Beijing presses ahead with its ambition to become a financial powerhouse by 2050.

BYD Electronic, which makes electronic devices such as smartphones for brands including Huawei, will add HK$76.15 billion (US$9.8 billion) in market capitalisation to the benchmark.

Hong Kong stocks were lifted by signs corporate earnings may have bottomed out, and after Beijing delivered a batch of property support measures.

Developer stocks rose on Thursday after authorities in Hangzhou announced plans to buy unsold homes, but analysts question whether such aid is the best way to rescue the market.

Saudi Arabia’s Public Investment Fund and Michael Burry’s Scion Asset Management increased their holdings of Chinese large caps, while Singapore’s Temasek reduced its stock holdings.

Hong Kong stocks rally continues after China unveils more property support measures with gains supported by hopes the Federal Reserve will start cutting interest rates later this year.

Bridgewater Associates, the world’s biggest hedge fund slashed its holdings drastically in the first quarter in a move may have been too hasty and caused it to miss out on the recent bull run.

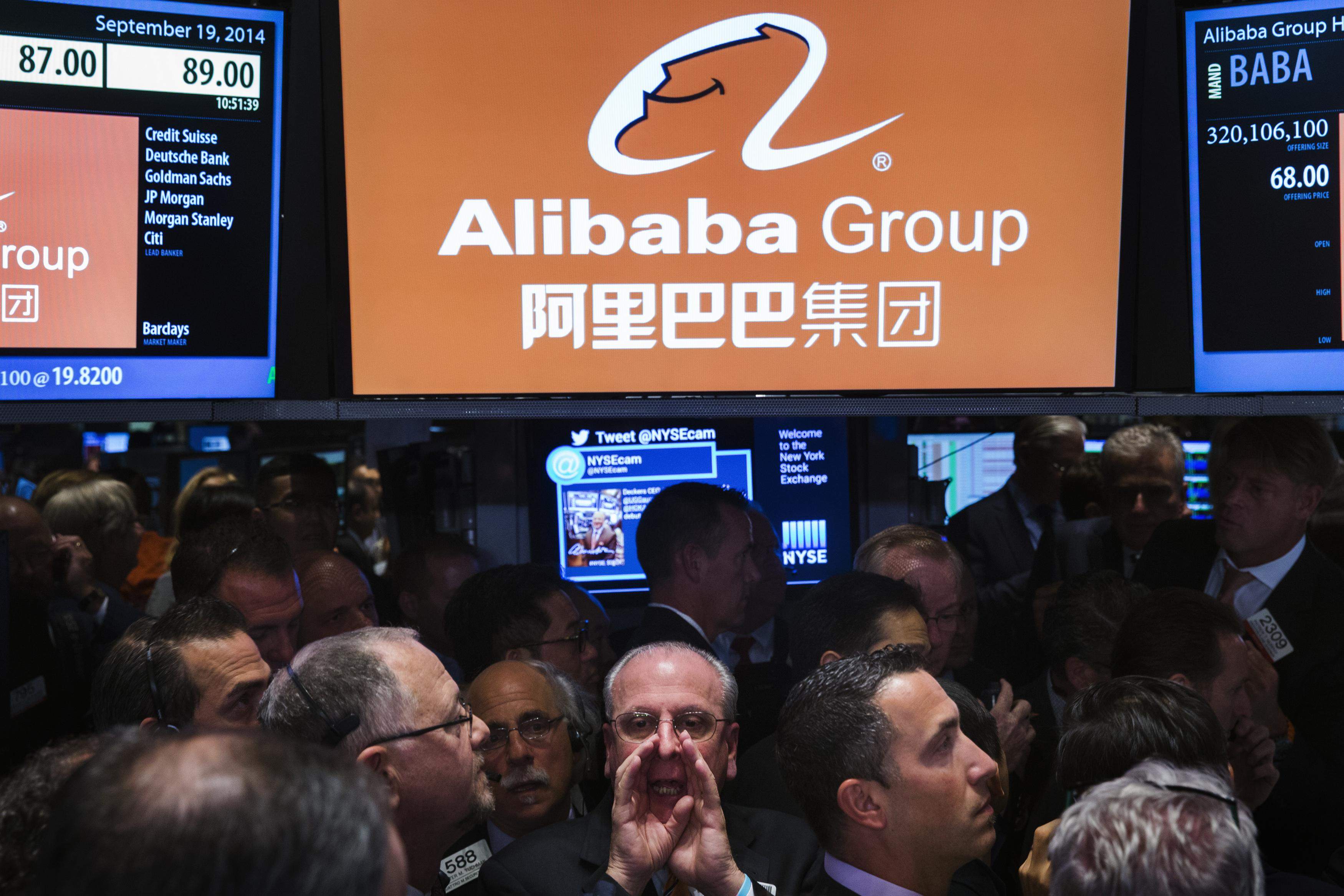

Alibaba Group Holding’s primary dual listing in Hong Kong could open the doors for China’s 210 million investors to buy a stake in the US$400 billion behemoth.

Mainland China stock markets are on the back foot after US-China trade tensions rose following increased tariffs on imports of Chinese semiconductors, electric vehicles, steel and batteries.

Enhanced mechanism set to boost international investors’ confidence in the onshore bond market and further internationalise the yuan, according to industry experts.

Asian Investors represented more than 17 per cent of qualified foreign investor activity on the Saudi Exchange’s main market in the first quarter.

Agile says it ‘will not be able to fulfil all payment obligations under its offshore debts’ because of liquidity pressure. Presales declined 68 per cent year on year to US$905 million from January to April.