Chinese EV industry pits battery swapping technology against ultra-fast charging

The duelling technologies are aimed at soothing consumer anxiety about driving ranges

Efforts by the Chinese electric vehicle (EV) industry to reduce consumer anxiety about driving ranges have pitted battery swapping technology against ultra-fast charging capabilities, even though both save time for drivers.

“Carmakers and consumers now have two options as they choose which kind of EVs to buy,” said Davis Zhang, a senior executive at Suzhou Hazardtex, a supplier of specialised batteries, in an interview last week. “Each of the technologies has its own advantages and disadvantages, but they will coexist over a long period of time.”

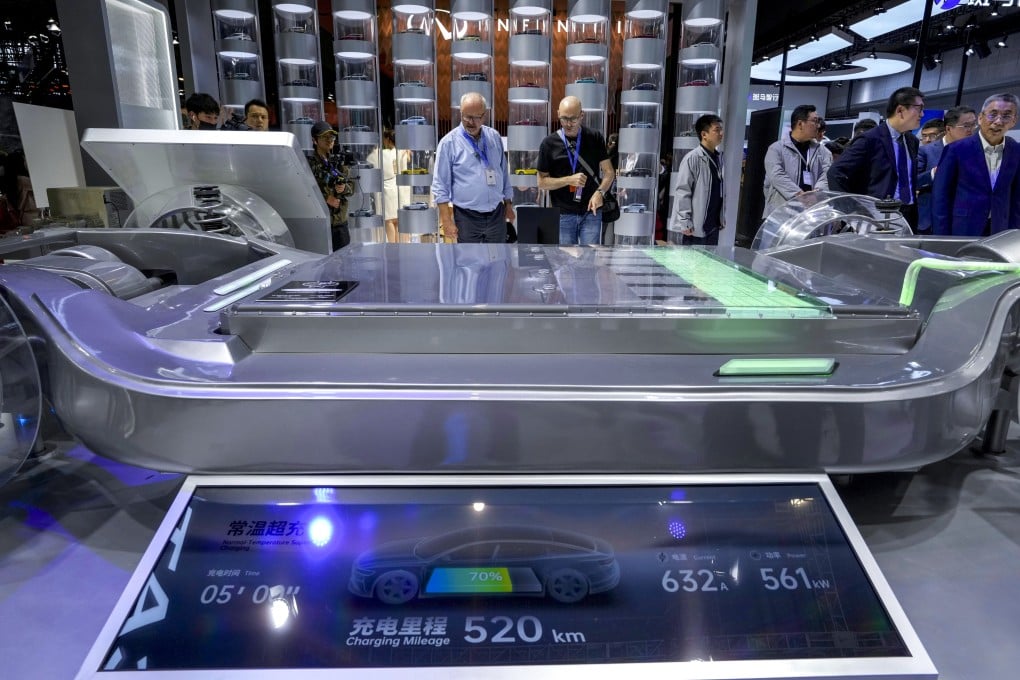

The battery swap model allows EV owners to exchange a spent pack for a fully charged one in just 100 seconds. And fast-charging technology gives a vehicle 400km of driving range in five minutes.

CATL plans to build 1,000 stations to support battery swapping in China this year. At the end of 2024, Robin Zeng Yuqun, the company’s founder and chairman, said CATL had secured subscription orders for 107,500 of its Choco-SEB swappable batteries from more than 30 companies.

Battery swapping has the potential to save a car buyer as much as 40 per cent of the cost of owning a new EV – amounting to 40,000 to 50,000 yuan (US$6,876) – because they can rent batteries from the carmakers or other firms.